Transition to a Decentralized Autonomous Trust (DAT)

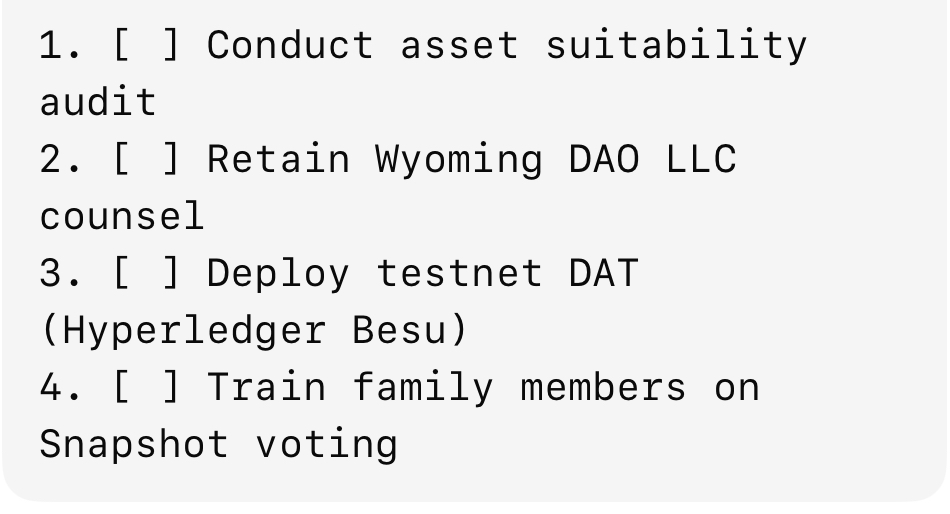

Pilot Program Initiation

for Family Offices

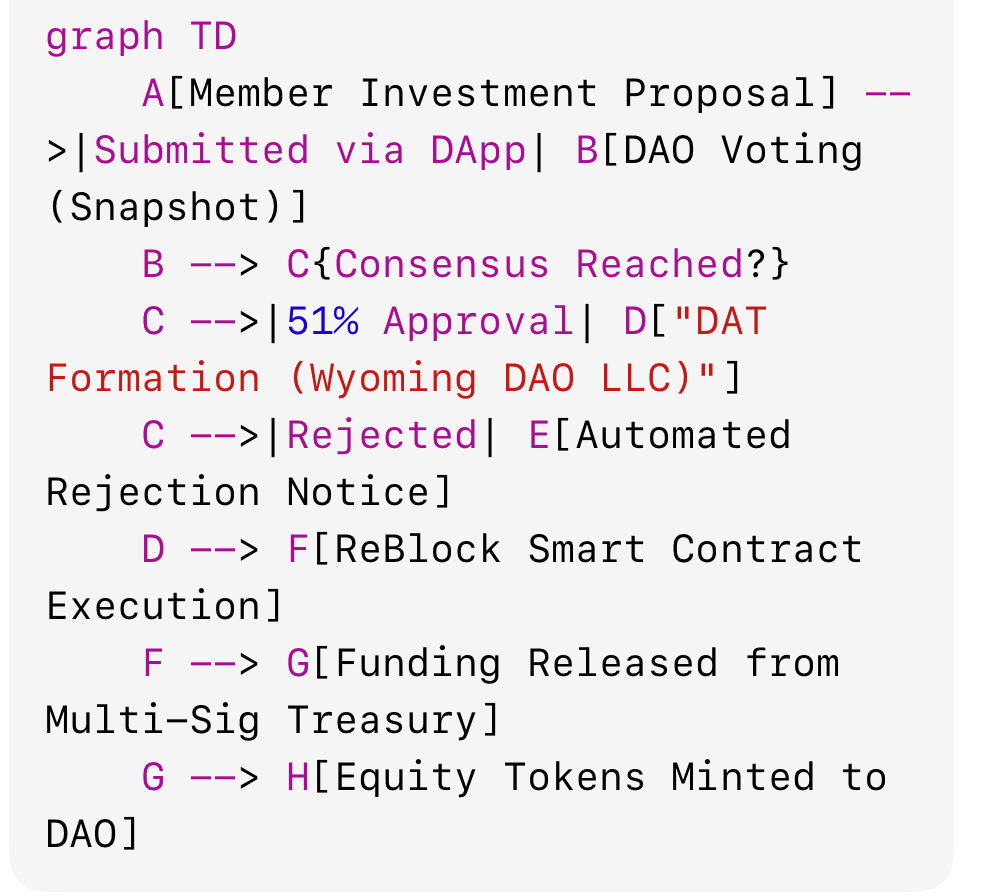

An existing Family Office will experimentally allocate a small business portfolio to a newly established (Permissionless Blockchain) DAT. This initial experimentation with automated governance of a designated section of an existing Family Office and the allocation of funds for profit will spurr internal innovation in areas like real time royalty and dividend payments, markets for delegates voting rights, and other synthetic assets involving tokenized stock or utility tokens dependig of the Family Office's assets. This is because each are unique both in asset groups and in the founders vision, how to manage them.

Asset Allocation Case Study:Identify 5-15% of the family office’s portfolio (e.g., royalties, or tokenizable non-core holdings) for migration to a permissionless blockchain-based DAT.

Example:Tokenize a real estate LP interest or venture capital stake as ERC-3643 security tokens.